Irrational Exuberance or Prudent Disposition: Explaining the apparent disconnect between the market and the economy

Rich Rund

Dir. Client Services & Business Development

Irrational Exuberance.

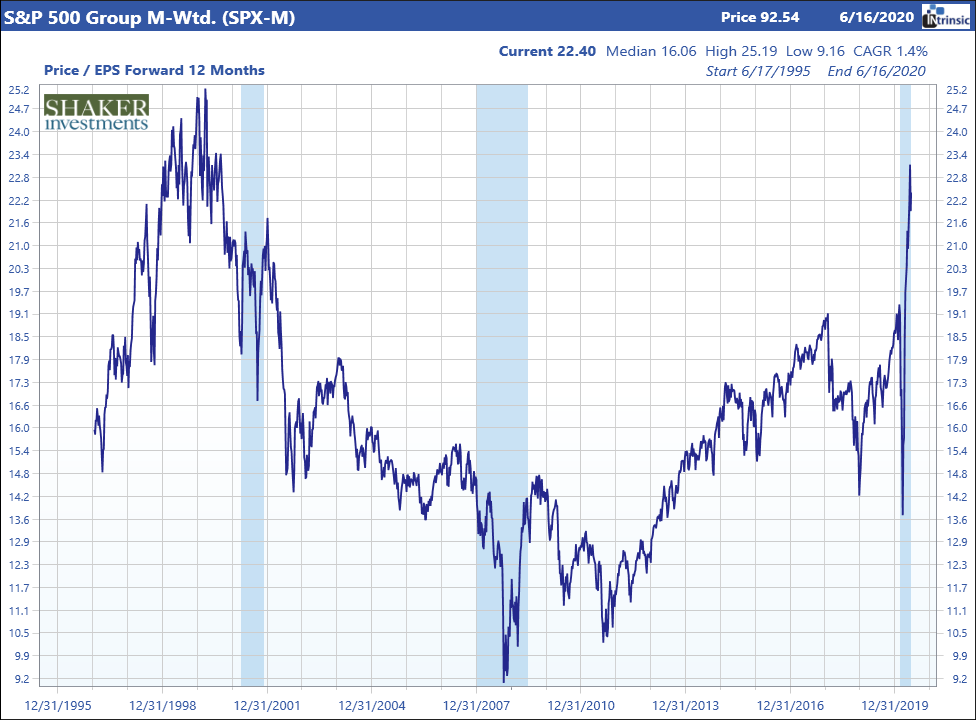

I have heard the term “irrational exuberance” thrown around a number of times in the past few weeks. Irrational exuberance, a phrase made famous by former Fed Chairman Alan Greenspan and also the title of a book by Yale professor Robert Schiller, describes investor excitement despite runaway stock valuations during market bubbles. The forward price-to-earnings ratio or P/E of the S&P 500 has been increasing alongside very negative economic data. Is irrational exuberance an accurate description of the current market?

Disconnect.

Recent economic data is bad but has been improving. This year real gross domestic product (GDP) declined 4.8% in the first quarter and the consensus among economists is for an eye-popping decline of more than 30% in the second quarter with a return to positive growth in the second half of the year. The unemployment rate was 14.7% in April, which was the highest unemployment rate since the Great Depression, but improved to 13.3% in May.

Despite the dire economic data, the market has been resilient. After reaching a low of 2237.40 on March 23rd, the S&P 500 has rallied 37% as of June 15th and is only about 10% off its all-time high. Not bad given we are in the middle of a deep recession and a global pandemic!

Investors may find it odd that the market has performed this well faced with such negative data. In fact, there are a few reasons that help explain the so-called disconnect between the economy and the market.

The Fed.

The Federal Reserve (Fed) announced in March that that it would double its balance sheet from $4 trillion to $8 trillion, adding liquidity to the market. The Fed does this through bond purchases. Typically the Fed buys treasuries or government backed bonds tied to agencies, but in this coronavirus-related quantitative easing (QE corona?) they have expanded their toolkit to include, among other things, indirect and direct purchases of corporate debt. As the Fed buys bonds, cash floods the financial system, and provides the liquidity for banks to continue lending. Much of this cash finds its way into other financial assets like stocks, bidding up prices. We saw similar market reactions during the last rounds of QE. As cash entered the financial system, forward P/E ratios started to increase.

Source: Intrinsic

The size and speed of Fed action likely explains much of the so-called disconnect between the economy and the market. The magnitude of the Fed’s actions can be seen in how much M2, which is a measure of the money supply, has increased – 23% compared to a year ago, which is the largest such increase for this measure.

Source: Board of Governors of the Federal Reserve System

In addition to QE, the Fed has signaled that its target interest rate will remain near zero for the foreseeable future. The inability to draw significant yield from the bond market could push investors to riskier assets, like stocks. More demand for stocks also pushes prices up. Do not fight The Fed.

Congress.

In addition to the liquidity provided by the Fed, Congress acted with unusual speed to approve several measures to fund businesses and augment state unemployment payments. In total, these measures amounted to about 10% of annual GDP, which is the broad measure of annual economic output in the United States. As a result, Personal Income in the United States increased 10.5% in April after declining 2.2% in March.

The future.

The big difference between economic data and the market is that economic data reports what has occurred, while the market looks forward and tries to predict the future. Even though recent economic data have been very bad, the market has already taken it into account. The market is pricing in what it expects to happen. Bad but improving economic numbers, excitement surrounding states reopening, pent-up consumer demand and the potential development of an effective treatment for COVID-19 is being reflected in market prices.

For instance, given the quick actions of the Fed and Congress, economists’ dire forecasts for the second quarter are likely to be overly pessimistic because they are based on past data. The same is true for analyst forecasts of earnings, which may make the forward P/E of the market lower than appears now. It turns out that the market updates its forecast quicker than economists and analysts.

A common pricing tool called the discounted cash flow (DCF) model forecasts all future cash flows to a firm and discounts them to arrive at a current value. If we are fortunate enough to have a vaccine in a year, and then things are mostly back to normal, one year of disrupted cash flows against all future flows should not have a huge impact on the current valuation. Of course, the longer the economy takes to return to normal, the larger the impact on current value.

Conclusion

While it may feel like the market reflects irrational exuberance, at least some of the price expansion can be explained by the swift and sizable actions of the Fed and Congress, plus investor expectations that the future will look better. If a vaccine is not developed in a reasonably short time, and if improved therapies are not available, the market will adapt and may come to reflect a less optimistic scenario.

Given the extremely high level of uncertainty in the world today, we are approaching this market with cautious optimism with an emphasis on cautious. The potential range of future outcomes for this market is quite wide and we are trying to be prepared for anything. Long-term, we believe that individual stock selection conducted through a rigorous and consistent process will have the most success.

Past performance is not indicative of future results. Investing involves certain risks including loss of principal. There is no guarantee that the investment objective will be achieved or that any investments or strategies discussed in this publication will be equally profitable in the future. Forward looking performance information and assumptions included in this article are for illustrative purposes only and may not prove to be correct. It is not intended as investment advice or recommendation, nor is it an offer to sell or a solicitation of an offer to buy any interest in any fund or product. Information herein has been obtained from public sources and we do not guarantee its accuracy.